Simplify your sustainability reporting!

The brick making sector in South Africa currently emits roughly 2.2 million tCO2e per year (Sector Sustainability Report 2018). Monitoring and reporting must cover all industrial processes, including fugitive and combustion emissions.

CBA Members have been making good use of The Sustainability Portal to report GHG emissions. The Portal ensures that they meet all the many stringent requirements in terms of data quality. Companies were able to calculate accurately, and were aware of their tax obligations well in advance.

Streamline your compliance process and minimise tax exposure with the Sustainability Portal, designed and developed by specialist partners EcoMetrix. If you are not yet making use of the Sustainability Portal, call for a free demonstration and expert assessment.

- 011 4477-892

- team@epcam.co.za

Reduce your tax risk by improving data quality

“The online Sustainability Portal includes a GHG Reporting and Carbon Tax module to streamline regulatory compliance and minimise tax exposure for companies,” says Lodewijk Nell of Ecometrix.

“Ensuring data quality and correctly calculating the tax liability is crucial, as failure to comply with regulations or providing false or misleading information carries penalties of up to R5 million or 5 years imprisonment for a first conviction and up to R10 million or 10 years imprisonment for subsequent convictions.”

While authorities might not enforce and apply these penalties immediately, it is a stern warning to data providers and taxpayers.

The Current greenhouse gas (GHG) emissions reporting threshold is a combined capacity under operational control of four million bricks per month. Amended National Reporting Regulations have reduced this threshold to one million bricks per month from ALL GHG sources.

The user-friendly, flexible dashboards are custom-designed for each producer’s reporting and monitoring needs

- Consumption and activity data can be captured across multiple sites and companies

- Measurable indicators for both direct and indirect GHG emissions and air pollutants.

- Missing data is flagged, there are out-of-bound warnings and based on this, values can be corrected.

- Tracking records a history of changes with comments.

- Supporting attachments can be added for auditability.

- GHG emission data is aligned to DEFF and SARS requirements

- Automatically aggregate your data and apply the appropriate IPCC code and technical factors.

- Calculate the correct basic allowance, trade exposure, tax-free emissions allowance and carbon tax offsets.

- Accurate, comparative data over time.

Correctly calculate your tax liability

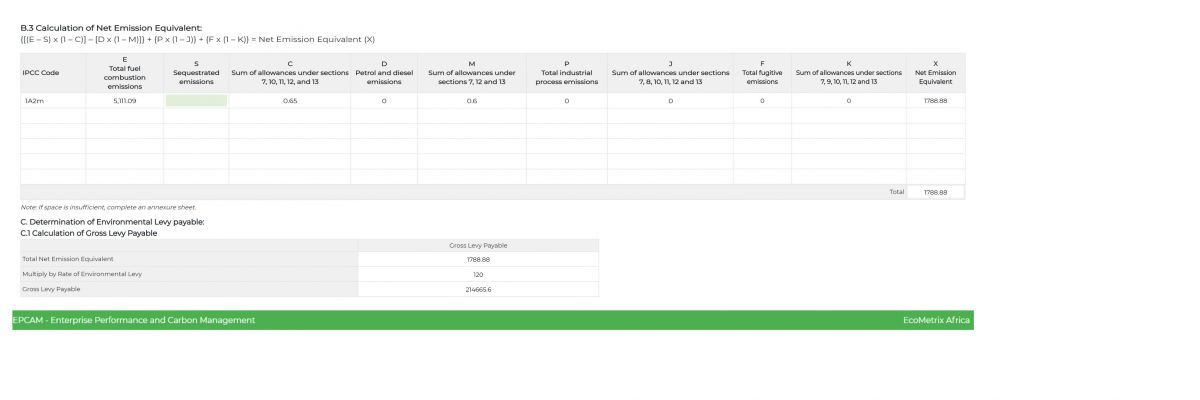

The carbon tax payable to SARS is based on the GHG Net Emission Equivalent calculations, as verified by DEFF. SARS will compare emissions reported to DEFF with the amounts used for calculation of the carbon tax payable. While a comparison is not possible for the first year (2019), SARS will require strict adherence to amounts reported in the GHG Report in subsequent years.

Data calculated must be complete, accurate and auditable, with measures to substantiate data collection. All data, reports, algorithms, systems and technical references used must be available for inspection and archived for five years.

SARS/DEFF may require data providers to verify and validate with supporting data and even undertake 3rd party validation and verification at their own cost.

The carbon tax rate is currently R120 per ton of carbon dioxide equivalent emissions (tCO2e), increasing annually by inflation plus 2% until 2022, and annually by inflation thereafter.

For clay brick makers, a basic tax-free emissions allowance of 60% applies during this first phase, with a potential top-up of up to 5% performance allowance if the company outperforms the sector benchmark. Taxpayers can further reduce their carbon tax burden by buying Carbon Tax Offsets covering up to 5% of the gross total GHG emissions.

The Carbon Tax module is automatically populated based on the information in the GHG Report module.

A special feature in this module is the selection of either the actual or default Net Calorific Value (NCV). By comparing actual vs default NCVs, tax liability can be optimised. If actual NCVs are selected, data must be supported by documentation such as lab analysis reports.

“Using the Sustainability Portal has allowed us to understand and optimise our reported and taxed emissions to avoid overpayment,” explains George Balambanos of Clyde Brickfields. “The support we received from the EcoMetrix team was excellent,” says George.

The online Sustainability Portal is sponsored by the Switch Africa Green Project. We thank all our project sponsors, as well as EcoMetrix and Partners for Innovation for their support and advice over the past three years. This project would not have been possible without the ongoing commitment of CBA members to greater sustainability in the industry. At the end of the project, sustainability and carbon tax advice and downloads will continue to be available at www.claybrick.org.